Shares of Jana Small Finance Bank saw a notable 20% surge on January 22, following the announcement of its Q3 FY25 results, which were accompanied by an optimistic statement from management that “the worst is behind us.”

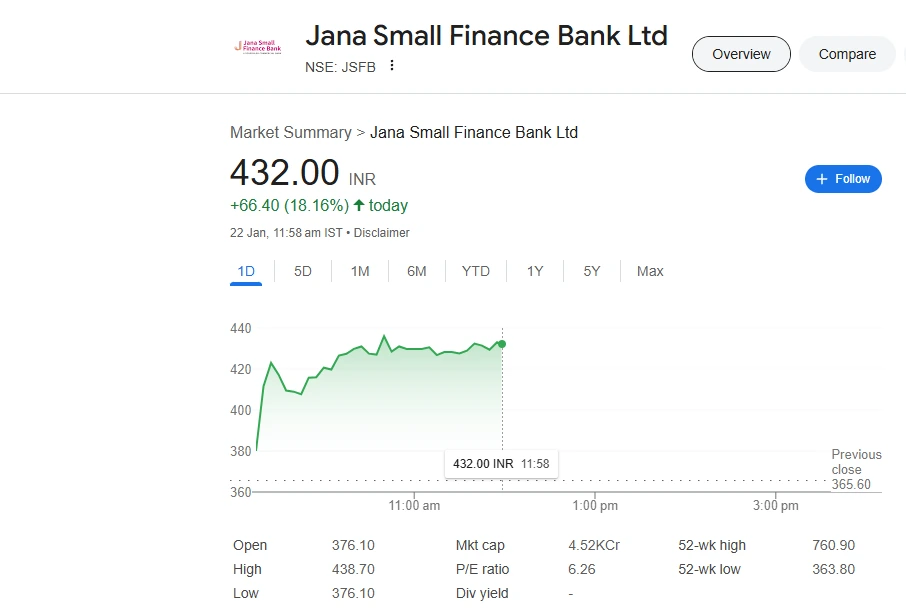

By 11:20 AM, the stock was trading 17% higher at ₹428. The year-to-date performance has been strong, with the stock up 6%, outperforming the Nifty 50 index, which gained 3% in the same period. However, the stock had faced consistent negative returns from July to December 2024, making this sharp rebound all the more significant.

For the third quarter ending December 31, 2024, Jana Small Finance Bank reported a 17.8% year-on-year decline in net profit, falling to ₹110.6 crore from ₹134.6 crore in the same quarter of the previous year.

Despite this dip, the bank’s net interest income (NII) rose by 8.1% to ₹593 crore, up from ₹548.5 crore in Q3 FY24. The bank also saw a positive trend in asset quality, with gross non-performing assets (NPA) improving to 2.80%, down from 2.97% in the previous quarter, and net NPA reducing to 0.94% from 0.99%.